EXECUTIVE SUMMARY

|

Dear Fellow Investors,

Learnings from winners of last 13 years

In the last 13 years, we have had some positions that have been up 10x-40x from initial purchase. Without ignoring the role of luck and avoiding the self-congratulatory trap, we try to objectively look back and distil eight common and combined patterns. Our hope is that internalizing these lessons will make us more sensitive to the causes and effects of winning, allowing us to spot and size ideas better in the future. Here is what we found:

- Competitive advantage: All these companies held a dominant position in their industry—some were monopolies or leaders in duopolies/ oligopolies. This dominance stemmed from durable “moats” that made it difficult for competitors to enter/ earn similar profits. These included, either singly or severally, regulatory licenses, low-cost structures, network effects, customer trust, prudent underwriting culture, long qualification cycles or switching costs. While high return on capital was a lagging indicator of their advantage, its sustainability was what helped them succeed.

- Large opportunity: Competitive advantage without growth is less valuable. Most of these companies served under‑penetrated, hard‑to‑substitute products or services, which gave them a long runway for healthy growth. Their competitive advantage allowed them to capture this growth profitably. Sources of runway included formalisation, rising equity participation, global chemical outsourcing, premiumisation etc. Equally, we have seen that a very large opportunity without a defendable advantage often ends in price wars or over‑building and is often not as successful.

- Low capital intensity and/or attractive reinvestment opportunity: Our best performers required minimal capital to grow (asset-light) or could reinvest retained earnings at healthy rates of return. In the asset-light models, excess cash was either returned to shareholders or, in the case of regulated entities, retained to provide regulatory stability. Others were more capital intensive, but had the ability to reinvest retained earnings at attractive, sometimes rising, returns on capital.

- Cheap/ Reasonable valuations: Stock prices of many of these companies fell over 40% multiple times in last 13 years. We were worried often. But on further thinking, we realised that while the price was down, the intrinsic value wasn’t down as much. This allowed us to initiate the position, stay invested, or add further. The following three were the main reasons why these strong companies were available cheaply:

- Temporary hardship: Technology setbacks, regulatory overhangs, credit tightening, cyclical downturns, demonetisation, IL&FS crisis, Covid‑19 and similar events created genuine short‑term pain for companies, sectors or the entire market. When familiarity/ deeper work suggested that the market was treating a temporary issue as permanent, these periods became fertile ground to accumulate strong businesses at attractive prices.

- Size: Smaller companies tend to experience higher volatility. In 2018 (IL&FS) and 2020 (Covid-19) correction, smaller companies fell more than larger ones, occasionally offering very attractive entry points. While the small-cap space is more crowded today, their low liquidity may create sharp falls in future. Our small size will be useful.

- Misunderstanding: In some cases, the companies faced misunderstanding on entry of competitor or competing products (example – mutual funds or diagnostics). In other cases, accounting changes like lease accounting understated accounting profits in comparison to economic profits.

- Management execution: The management teams of our winners demonstrated key traits: efficiency, focus (no diworsification), handling crisis, conservative with debt, prudent capital allocation, clean accounting, fair treatment of minority shareholders etc. This applied equally to founder-led and professional management teams.

- Not selling purely on moderate over valuation: We learnt to let winners run as long as fundamentals remain intact, tolerating moderate over valuation. If prices can irrationally fall 40-50%, they can also rise far beyond reasonable valuations especially when a company is ‘discovered’ by the market. In such positions, it is better to wait for leading indicators—unit economics, balance sheet quality, regulatory risk, capital allocation– to worsen before taking the trim/sell decision.

- Allocation: In some cases, we regret that our position size was too small to matter. In others, where we had a more familiarity and deeper conviction, we sized the position meaningfully enough to move the needle. Sizing is not a function of potential upside, but of the conviction that we cannot lose money.

- Luck: Luck has played a real role. Some companies found themselves in the right place at the right time or benefited from structural tailwinds that were stronger than we anticipated: post‑Covid equity participation, China+1 in chemicals, regulatory shifts such as RBI’s stance on unsecured lending, or favourable changes in consumer behaviour. Often market also goes through bullish phases and ascribes higher multiples (like currently). Not every success should be attributed to skill. When most of the above seven factors fall in line, chance of good luck rises. Recognising the impact of good luck and not getting carried away is necessary to elongate its run.

It is rare for all the above forces aligning for a company. Further, it is difficult to identify these forces as they play out in real time. Also, they can keep on changing. Moats erode, growth falters, management makes mistakes or temporary hardships turn out to be permanent.

A portfolio of companies having most of these factors present (including reasonably priced incorporating margin of safety) and diversified among their exposures increases our odds of success. This requires us to raise the bar for investment worthy candidates and wait till these factors align.

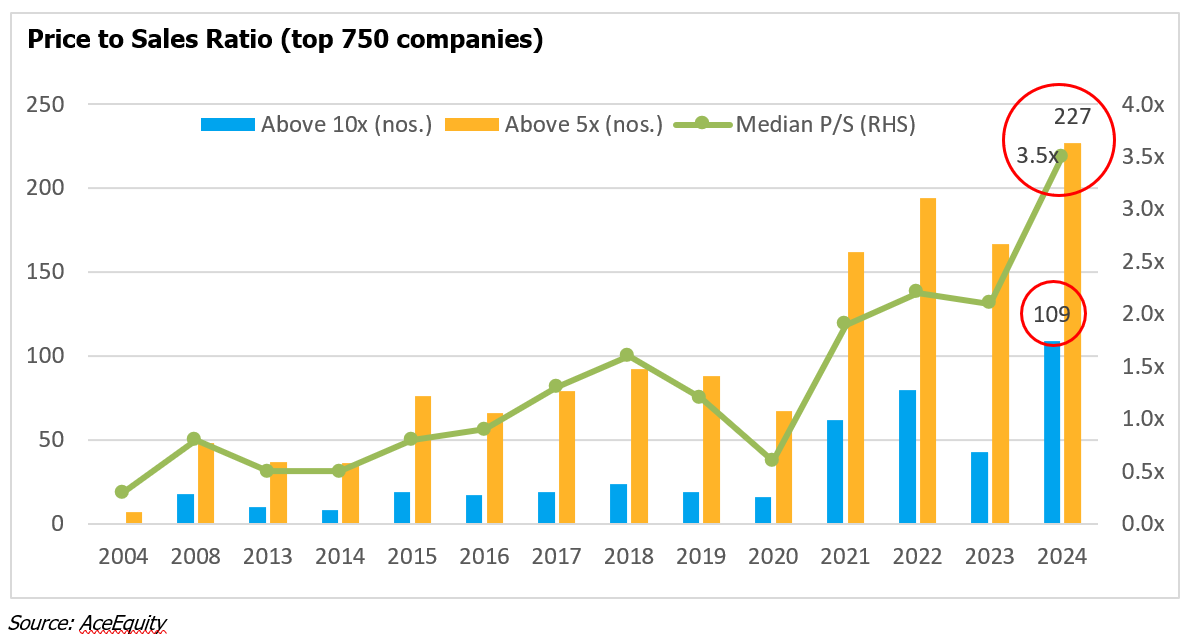

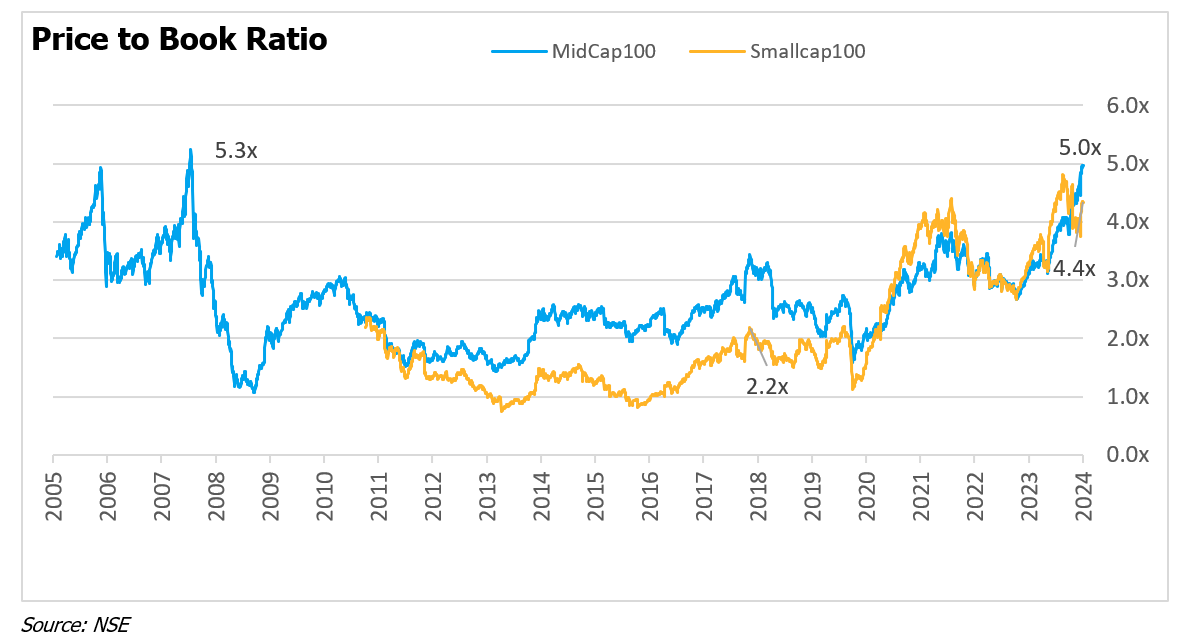

When looking at today’s markets, the key missing ingredient is price. There are only some pockets where, either due to temporary hardships or misunderstanding, price remain reasonable. We continue to remain selective and patient. STANCE: NEUTRAL

A. PERFORMANCE

A1. Statutory PMS Performance Disclosure

| Year Ended | CED Long Term Focused Value (PMS) | BSE 500 TRI (Benchmark) | Difference | ||

| Return | Avg. Cash Eq. Bal. | Return | Trailing P/E | ||

| YTD FY26 | 25.7% | 19.9% | 12.6% | 25.2x | +13.1% |

| FY 2025 | 10.3% | 21.0% | 6.0% | 23.4x | +4.3% |

| FY 2024 | 29.2% | 26.1% | 40.2% | 26.2x | -11.0% |

| FY 2023 | -4.3% | 30.0% | -0.9% | 22.3x | -3.4% |

| FY 2022 | 14.9% | 38.5% | 22.3% | 25.0x | -7.4% |

| FY 2021 | 48.5% | 29.0% | 78.6% | 38.0x | -30.1% |

| FY 2020* | -9.5% | 23.0% | -23.4% | 18.3x | +13.9% |

| Since Inception(6Y) | 16.3% | 27.3% | 17.1% | -0.8% | |

| *From Jul 24, 2019; ‘Since inception’ performance is annualised; Note: As required by SEBI, the returns are calculated on time weighted average (NAV) basis. The returns are NET OF ALL EXPENSES AND FEES. The returns pertain to ENTIRE portfolio of our one and only strategy. Individual investor returns may vary from above owing to different investment dates. Annual returns are audited but not verified by SEBI. | |||||

Quarters Vs Decades

In a multi-decade investing journey, what ultimately matters is the rate of long-term compounding, not the sequence of short-term returns. A portfolio that earns modest returns in its early years but compounds well later can equal—or even outperform—one where the sequence is reversed. The key risk to avoid is a large permanent loss, because returns are multiplicative: even a very large number, when multiplied by zero, remains zero.

While regulations require us to report performance every quarter, our investment process is not designed to optimise for short-term outcomes. In the short run, prices can fluctuate for reasons unrelated to business fundamentals. Celebrating or lamenting quarterly for over-or-under performance often distracts from what truly matters: focus on understanding the long-term future economics of businesses, maintaining a watchlist of high-quality companies, and investing in them only when prices offer a reasonable margin of safety. When such conditions are absent, patience is a deliberate choice. We believe this discipline is what delivers strong absolute returns over decades, irrespective of quarterly lag.

Our responsibility is to adhere to this process consistently and to report outcomes transparently every quarter. Since investing is inherently about the future, even well-researched decisions can prove wrong or premature. When that happens, it is equally our responsibility to communicate it openly. The above performance table and this letter should be viewed with this context in mind.

A2. Underlying business performance

| Past Twelve Months | Earnings per unit (EPU)2 | FY 2026 EPU (expected) |

| Sep 2025 | 10.61 | 10.2-11.03 |

| Jun 2025 (Previous Quarter) | 10.0 | 10.0-10.83 |

| Sep 2024 (Previous Year) | 8.9 | |

| Annual Change | 19.1% | |

| CAGR since inception (Jun 2019) | 13.5% | |

| 1 Last four quarters ending Sep 2025. Results of Dec quarter are declared by Feb only. 2 EPU = Total normalised earnings accruing to the aggregate portfolio divided by units outstanding. 3 Please note: the forward earnings per unit (EPU) are conservative estimates of our expectation of future earnings of underlying companies. In past we have been wrong – often by wide margin – in our estimates and there is a risk that we are wrong about the forward EPU reported to you above. | ||

Trailing Earnings: Last twelve months earnings of the underlying portfolio companies attributable to us (we call it Earnings Per Unit) grew by 19.1% over the previous period.

1-Yr Forward Earnings: After better-than-expected earnings outcome in the recent quarter, we are upgrading our expectation-range of FY 26 Earnings per Unit slightly from Rs 10-10.8 to Rs 10.2-11.0.

A3. Underlying portfolio parameters

| Dec 2025 | Trailing P/E | Forward P/E | Portfolio RoIC | Portfolio Turnover1 |

| CED LTFV (PMS) | 24.9x | 24.1x-25.9x | 39.0%3 | 6.3% |

| BSE 500 | 25.2x2 | – | 17.4%2 | – |

| 1 ‘sale of equity shares’ divided by ‘average portfolio value’ during the year to date period. 2Source: Asia Index. 3Portfolio Return on Invested Capital (RoIC) is on core equity positions. For BSE 500 index we share the RoE (Return on Equity) | ||||

B. DETAILS ON PERFORMANCE

B1. MISTAKES AND LEARNINGS

We did not discover any new mistakes this quarter.

B2. MAJOR PORTFOLIO CHANGES

Bought: We introduce a new position . We also added further to an existing position.

Sold: We trimmed a position especially in older accounts where the weight had run up due to rise in the share price and moderation in leading fundamental indicators.

B4. FLOWS AND SENTIMENTS

Flows and sentiments continue to remain strong in Indian equity markets leading to high valuations in most of the pockets.

Monthly retail inflows into Indian mutual funds remain positive for last 43 months negating selling from foreign investors in secondary markets and insiders (promoters and private equity investors) in primary markets (IPOs, QIPs, Preferential allotments, rights etc).

Global flows have moved away from India to other Asian markets such as South Korea, Japan and China due to (a) cheaper valuations and (2) exposure to artificial intelligence (AI), electric vehicles (EV) and batteries. The valuations of Indian markets still remain high so it will be difficult to predict when will relative underperformance of India reverse.

AI related companies in the US continue to drive most of the US market returns and GDP growth. There are polarising views about whether we are in AI capex/ share price bubble. We have no special insight to add to the matter. Through one position we have exposure to this theme at valuations much cheaper than US. If AI continues to ride along, the markets may remain stable but not run away (good news mostly priced in). But if AI turns out to be a bubble, not just US markets but Indian markets will also feel the heat. We have some exposure to so called anti-AI themes (India as a whole is also being called anti-AI, but we don’t know) but cannot be assured that they will indeed work. So being partly in cash/ cash equivalent is the simplest way to profit from AI bubble pop, if any.

C. OTHER THOUGHTS

Imagining a world where AI runs public-market investing

Humans bring emotion to investing — greed, fear, envy, FOMO — while celebrated investors preach machine-like rationality. High-frequency and algorithmic trading already automate parts of that ideal. Let’s run a thought experiment: suppose AI agents fully take over investing in public (listed) markets (we’ll exclude private and venture capital). What would need to be true for this to work well — and what might follow?

Prerequisites: For an AI takeover to function without catastrophic failure, three structural pillars are required:

- Agentic Diversity – Efficient price discovery depends on participants with different goals and time-horizons. Some AI agents should be momentum-driven, others value-oriented, some income-focused, some liquidity providers, etc. Without heterogeneous objectives, markets risk becoming inefficient and illiquid.

- Regulatory guardrails– Rules must limit excessive concentration and systemic risk: sectoral limits, leverage and derivatives caps, circuit breakers, caps on AUM or trade volume for any single algorithmic entity, and controls to prevent regulatory arbitrage across jurisdictions.

- Human in the loop – Total autonomy is dangerous. We need accountability mechanisms and “kill switches” for anomalies. Furthermore, decisions must be explainable—regulators need to distinguish between genuine asset repricing and a “hallucination” in the model’s logic.

Consequences: If AI agents are allowed to autonomously manage investing, there may be both good and bad outcomes:

Positive consequences:

- More efficiency, death of alpha – AI agents will be able to search, scrape, summarise and analyse more data faster and more accurately than the best human. Asset prices will be instantly discount events in real time. Stock returns will be restricted to normal profits and there may be no one who could beat the market (no alpha).

- Better Capital Allocation – Human-led markets are prone to bubbles, allocating capital to unworthy projects during euphoria and starving good businesses during busts. A rational AI market could theoretically smoothen these cycles, allocating capital strictly based on merit and expected returns on capital.

Negative consequences:

- Game theory –Each AI agent will try to optimise the goals set for it within the constraints ignoring consequences. An AI agent with a long position in company X may hire agents to harm competitors of company X. In another case, there can be fake sell orders by value agent that leads momentum agents to keep selling.

- Threat to diversity–If one style outperforms, capital and computing power may move to that style. As marginal buyer/ seller sets the price –stronger styles will determine prices. For example, if momentum AI outperforms and get stronger it may lead to rising prices, as the selling by outnumbered value may not counter them.

- Insider Access: In a world where public data is perfectly priced, the only remaining edge is illegal. This creates a massive incentive for AI to seek non-public/insider information, raising complex compliance and privacy challenges

- Black swan event: AI models are trained on past data. In case of a black swan event (new crisis) never seen in the training data (eg: global cyber-attack or new pandemic) AI models may freeze.

Regardless of whether markets ever become fully AI-driven, Investors cannot afford to treat AI as a distant risk or a passing tool. Staying competitive will require continuously understanding how AI is reshaping information flow, price discovery, and investor behaviour—and systematically integrating it into research, monitoring, and decision-making processes.

For maintaining market integrity, however, AI should be used to augment human judgment and not replace it. AI can be used for automating data gathering, accelerating analysis, stress-testing assumptions, and flagging anomalies, while humans retain responsibility for context, ethics, and capital allocation. In a world where information advantages compress rapidly, the edge will not come from resisting AI, but from learning to work alongside it better than others.

***

As always, gratitude for your trust and patience. Kindly do share your thoughts, if any. Your feedback helps us improve our services to you!

Kind regards

Sumit Sarda

Partner and Portfolio Manager

————————————————————————————————————————————————-

Disclaimer: Compound Everyday Capital Management LLP is SEBI registered Portfolio Manager with registration number INP 000006633. Past performance is not necessarily indicative of future results. All information provided herein is for informational purposes only and should not be deemed as a recommendation to buy or sell securities. This transmission is confidential and may not be redistributed without the express written consent of Compound Everyday Capital Management LLP and does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product. Reference to an index does not imply that the firm will achieve returns, volatility, or other results similar to the index.