EXECUTIVE SUMMARY

|

Dear Fellow Investors,

High expectations (valuations) steal the joys of life (investing)

Stock prices reflect future expectations. The higher the expectations, the lower the room for positive surprise—both in life and investing. When valuations are stretched, the risk of disappointment rises, making aggressive investments at elevated prices a potential recipe for regret.

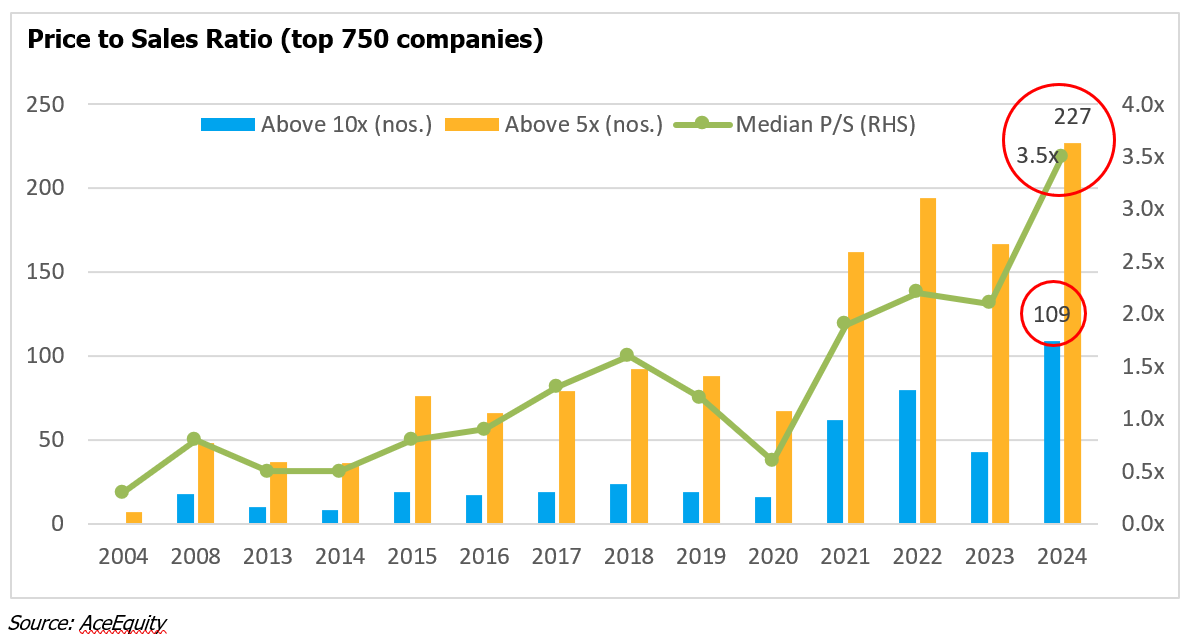

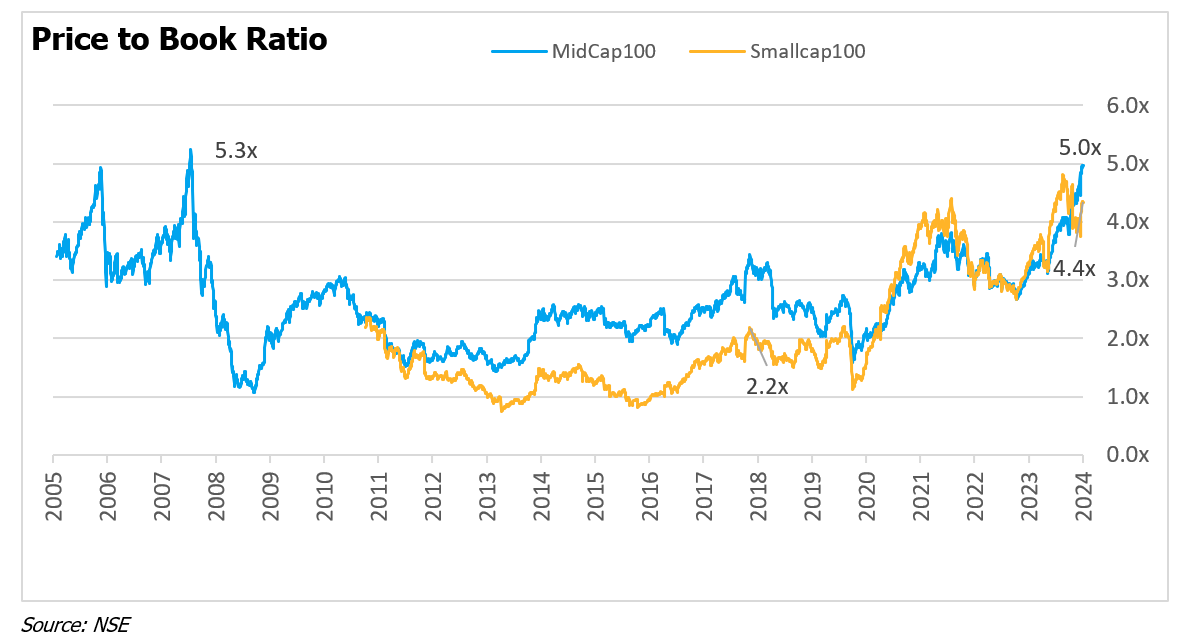

As of 31st March, about 50% of the top 700 companies (market cap > Rs 5,000cr) traded at or above 40x trailing price to earnings (P/E) ratio (including loss making companies). This is after some moderation from Sep 2024 highs when that count was over 60%. Average P/E of BSE 500 index has been around 22x for past two decades.

A 40x P/E roughly builds in an expectation of an 18% annual free cash flows growth for a decade, followed by 5% growth for the next 90 years. At 100x P/E, those expectations rise to 25% and 8%, respectively—expectations that nearly 10% of these companies are pricing in today!

Of these 40x+ P/E companies having listing history of 10+ years, only 20% have been able to grow their earnings at or over 18% for last 10 years. The median 10-year earnings growth of these companies has been 15%. A caveat here – many sectors are at their cyclical top – for example PSU banks, railways, defence, capital goods, real estate, power, oil & gas, hospitals, hotels, capital market facing firms etc. There are high chances that the median future 10-year earnings growth for this cohort will be lower than 15%.

Sustaining high growth for decades requires two ingredients—moat and demand. Moat or competitive advantage refers to entry barrier(s) that provides protection against competition, while demand determines the size of the opportunity. Of the two, moat is essential. Without a moat, rapid growth attracts competitors, squeezing margins and returns. Even if this is temporary, picking ultimate winner becomes difficult.

Today, Indian companies trading at or above 40x P/E span diverse sectors – auto and auto-ancillary, paints, wires and cables, quick commerce, airlines, hospitals, hotels, footwear, clothing, retail, luggage, solar, wind, jewellery, FMCG, QSR (quick service restaurants), electrical appliances, salty snacks, writing pens, plastic products, commodity chemicals etc.

Many of these sectors have no, narrow, or weakening moats. Two broad factors are driving such high valuations:

1. Overestimating fundamentals:

- Misjudging growth: Cyclical/ temporary growth is misjudged as structural tailwind (e.g., the Indian chemical sector post-2014, COVID-driven demand spikes in healthcare, capital goods due to government capex etc.).

- Overestimating market size: Many consumer categories in India have a smaller actual market than initial optimism suggests. Also, a part of consumption is fuelled by unsustainable debt.

- Weakening competitive advantages: Technological shifts and new distribution models (e-commerce, quick commerce) have weakened moats in many sectors including FMCG, retail, consumer durables, and quick service restaurants (QSRs). Artificial Intelligence may also disrupt moats in future.

- Growth attracting competition: High-growth sectors such as telecom, paints, wires, airlines, retail, and diagnostics have seen new entrants dilute profitability.

- Overestimating management quality– Great managements protect and/ or strengthen the moat through culture, capital allocation and efficient execution. Without moat, however, their abilities to protect growth and profitability is reduced (passenger vehicles for example). The subset of businesses, where management is the moat (banking and general insurance for example) is small. Outside of this set, giving high multiples for business lacking strong moat only because of quality management may lead to overvaluation.

- Regulatory tailwinds – Regulations or government protection can give temporary bouts of growth (eg, public capex, license etc); however, regulations and governments can change. Price curbs or caps can be introduced in consumer interests (eg telecom, real estate, micro finance, city gas distribution etc.).

2. Flows driving prices: Often non-fundamental reasons like global and local flows (due to momentum, index inclusion, or lack of alternative opportunities) can drive prices. The current episode of buoyant prices in India can partly be attributed to unprecedented flows from retail investors further supported by ease of trading and positive narratives painted by media and fund managers. In such an environment, price movements become shorthand for quality, and the belief that “rising prices equal strong fundamentals” can take hold. This creates a self-fulfilling prophecy where valuation metrics and underlying business fundamentals are overshadowed by the prevailing market sentiments.

In the short run, imaginations can continue to run wild and valuations can stretch beyond reason. However, the maths ultimately needs to add up. Time ultimately acts as a reality check. If growth, profitability or capital intensity turns out weaker than lofty expectations, price resets can be sharp.

Investing involves looking into the future and many times it is not that easy to judge the nature of moat and future growth. These are all the more reasons to demand margin of safety.

Markets fell from their Sep’24 highs and they recovered some ground in the month of March. As of writing of this letter, US tariffs have led to fall across markets including India. While valuations in many pockets continue to imply unreasonably high expectations, some entry points have emerged. Changing the stance from Cautious to Neutral.

A. PERFORMANCE

A1. Statutory PMS Performance Disclosure

| Portfolio | FY25 | FY24 | FY23 | FY22 | FY 21 | FY 20* | Since Inception* | Outper-formance | Cash Bal. |

| CED Long Term Focused Value (PMS) | 10.3% | 29.2% | -4.3% | 14.9% | 48.5% | -9.5% | 14.0% | 21.0% | |

| S&P BSE 500 TRI (includes dividends) | 6.0% | 40.2% | -0.9% | 22.3% | 78.6% | -23.4% | 17.2% | -3.2% | NIL |

| *From Jul 24, 2019; Since inception performance is annualised; Note: As required by SEBI, the returns are calculated on time weighted average (NAV) basis. The returns are NET OF ALL EXPENSES AND FEES. The returns pertain to ENTIRE portfolio of our one and only strategy. Individual investor returns may vary from above owing to different investment dates. Annual returns are audited but not verified by SEBI. | |||||||||

Risk is under our control, not returns

The above statutory performance table captures returns but not risks. That’s because risk isn’t a neatly quantifiable number that can be benchmarked periodically. Yet, managing risk—not predicting returns—is the one aspect of investing firmly within our control. A simple but difficult way to do so is by focusing on the quality of the businesses we own and the price we pay for them. And, in absence of either, waiting for them by parking the cash in liquid and safe instruments.

The secret in equities is that in long term, low risk can lead to moderate to high returns for most investors, but high risks lead to lower returns for most investors. Operating word is “most”. A few may achieve extraordinary short-term success through sheer luck or randomness, but for the vast majority, the only dependable way to earn satisfactory returns is through consistent risk management.

However, much like vaccines or insurance, risk control often feels unnecessary in investing. As long as things are going well, all three seem like an avoidable cost, a needless drag. But their true value becomes clear when uncertainty strikes. The prudent approach is to spread this cost over time, rather than defer it, because risks, when ignored, can compound and strike with fatal force.

Investors got a glimpse of this in the latter half of FY 2024-25. For many newer participants, the market correction may have been a shock. But for experienced investors, it was not unexpected. We had been preparing—not by making dramatic market calls, but by being cautious and accepting smaller, more manageable doses of discomfort: the pain of underperforming and looking out of sync when euphoria prevailed. Our higher cash equivalents amid lack of meaningful opportunities over last few years was a result of this caution. It took its toll in terms of lesser relative returns. But that’s a far better price to pay than the alternative—finding oneself out of money, conviction, or emotional strength when the tide turns.

A2. Underlying business performance

| Past Twelve Months | Earnings per unit (EPU)2 | FY 2025 EPU (expected) |

| Dec 2024 | 9.21 | 8.5-9.53 |

| Sep 2024 (Previous Quarter) | 8.9 | 8.5-9.53 |

| Dec 2023 (Previous Year) | 8.0 | |

| Annual Change | 15.0% | |

| CAGR since inception (Jun 2019) | 13.0% | |

| 1 Last four quarters ending Dec 2024. Results of Mar quarter are declared by May only. 2 EPU = Total normalised earnings accruing to the aggregate portfolio divided by units outstanding. 3 Please note: the forward earnings per unit (EPU) are conservative estimates of our expectation of future earnings of underlying companies. In past we have been wrong – often by wide margin – in our estimates and there is a risk that we are wrong about the forward EPU reported to you above. | ||

Trailing Earnings: So long as we do not overpay, our returns will track or exceed the earnings growth of our underlying companies. We track the earnings available to per unit of PMS through Earnings per Unit (EPU) metric. This is calculated by taking normalised earnings accrued to our portfolio divided by PMS units. For the trailing twelve months ended Dec 2024, our EPU came in at Rs 9.2 per unit, higher by 15% year on year.

1-Yr Forward Earnings: We retain our EPU guidance for FY25 at the range of Rs 8.5-9.5 per unit.

A3. Underlying portfolio parameters

| Mar 2025 | Trailing P/E | Forward P/E | Portfolio RoIC | Portfolio Turnover1 |

| CED LTFV (PMS) | 23.0x | 22.3x-24.8x | 37.0%3 | 11.7% |

| BSE 500 | 23.4x2 | – | 16.5%2 | – |

| 1 ‘sale of equity shares’ divided by ‘average portfolio value’ during the year to date period. 2Source: Asia Index. 3Portfolio Return on Invested Capital (RoIC) is on core equity positions. For BSE 500 index we share the RoE (Return on Equity) | ||||

B. DETAILS ON PERFORMANCE

B1. MISTAKES AND LEARNINGS

There were no mistakes to report in this period.

B2. MAJOR PORTFOLIO CHANGES

Bought: We added to two existing positions.

Sold: We have completely exited from CDSL at 8x gain from our average cost.

CDSL Exit (8x gains) and Learnings

In our past letters, we’ve shared our approach to selling—while we tolerate some overvaluation as long as fundamentals remain stable, we reassess when they weaken. In the case of CDSL, we believe the fundamentals are now weakening.

CDSL’s revenue is significantly tied to equity market activity, including cash market deliveries, IPO applications, corporate actions (rights issues, bonuses, buybacks, etc.), and KYC transactions. A bull market of last four years has helped CDSL increase its profits by 3.3x. However, as markets declined 7-9% in the December quarter, CDSL’s revenue growth slowed. Given CDSL’s high fixed-cost base, profit after tax (PAT) grew even more slowly than revenue.

Looking ahead, we expect India’s exceptionally high retail participation—up 3-10x over the past four years—to moderate as market valuations remain elevated and volatility increases. Meanwhile, fixed costs like employee and technology expenses will remain sticky, putting further pressure on profitability. At the price we exited, forward valuation multiples looked demanding in this context.

We have exited our CDSL position with an 8x gain over five years. CDSL allowed us to experience, first hand, the power of duopoly, capital-light businesses and impact of mega trends—surge in retail investor participation in this case. Hopefully, we will over allocate to such cases next time. For now, it goes back to our watchlist.

B4. FLOWS AND SENTIMENTS

Smallcap and midcap equity indices fell 16 and 11% respectively last quarter, despite continued positive inflows into smallcap and midcap mutual funds. The decline was driven by selling from foreign and high-net-worth investors on thin volumes rather than a slowdown in domestic fund flows.

This correction has tempered excessive bullishness in riskier market segments—a welcome development. However, if retail investors start redeeming from mutual funds, liquidity constraints could amplify the downturn. On the other hand, sustained inflows might mark a bottom. As always, timing is uncertain, and with valuations still elevated, caution remains key.

Globally, trade tensions are back in focus, with the return of US tariffs under President Donald Trump. Trade policies are unpredictable, and history suggests that protectionism often leads to economic inefficiencies and, in extreme cases, geopolitical instability. While growth slowdown and inflation concerns in the US may limit aggressive escalation, the risk of negative surprises has risen.

Meanwhile, artificial intelligence (AI) is reshaping the technology landscape. US tech giants are investing heavily in AI infrastructure, while Chinese firms like DeepSeek and Baidu are emerging contenders. As with past technological revolutions—railways, radio, automobiles, and the internet—the winners remain uncertain. AI’s impact on healthcare, mobility, security, and automation presents both opportunities and disruption risks.

Both tariffs and AI add to global uncertainty, reinforcing that we remain demanding of multiples we pay for equities.

C. OTHER THOUGHTS

Market Eras and Investment Beliefs

Beliefs are shaped by direct and vicarious experiences – both in life and investing. Market regime/ era that investors live through influence their risk appetite, valuation frameworks, and core investment beliefs. Here are some of the historical investing eras:

- The 1930s and the Great Depression: The 1929 crash in the US led to prolonged stagnation, with U.S. stocks not recovering for 25 years. Investors from this era viewed equities as risky, favouring bonds, dividends, and capital preservation.

- The Inflationary 1970s: High inflation during 1970s in the US compressed valuations and led to negative real returns. Bonds and commodities became preferred investments, reinforcing inflation sensitivity among investors of that era.

- The Great Bull Market (1980–2020): 40 years of falling interest rates fuelled a multi-decade bull market, driving valuations higher and benefiting long-duration assets like technology stocks. Passive investing and private equity thrived, while ‘buying the dip’, became a reliable strategy.

- The Japanese Equity Winter (1990–2020): Japan’s post-real-estate-bubble stagnation left investors conservative, prioritizing cash preservation. Even decades later, Japanese households remain underweight equities despite global market strength.

- India’s ‘Lost Decade’ (1992–2001): After the Harshad Mehta crash, the Sensex remained flat for nearly a decade, fostering scepticism toward equities. Many Indian investors turned to fixed deposits (FD rates were over 12%), real estate, and gold, delaying the cultural shift toward equity investing until the mid-2000s.

Those who have lived in declining or stagnant markets develop cautious attitude and those having lived through bullish times develop a carefree attitude to investing. Much like Plato’s allegory of cavemen, these attitudes are so strong that it is difficult to convince them that other eras exist. In The Republic, Plato shares a story about a group of people who lived their entire lives chained inside dark cave facing a wall. Behind them was a fire, and between the fire and the prisoners was a walkway. On this walkway, others carried objects, puppets, and shapes, casting shadows on the wall in front of the prisoners. When one of the cavemen escaped and discovered the real world, his attempts to enlighten the others were met with disbelief and resistance.

India’s Post-Pandemic Boom (2020–2024): Of the 20 crores demat accounts live today in India, 15 crores (75%) were opened in the last four years. Many of these investors have only seen a rising market, believing 20% annual returns are the norm. Veteran investors, who have experienced multiple cycles, warn against such high expectations. But much like the cave prisoners dismissing the freed man, such advice falls on deaf ears.

Common themes and thinking about current Era

While it is nearly impossible to predict start or end of an era, one commonality is that like night following day, bullish eras have been followed by bearish ones and vice versa. The duration of either of them is unpredictable. However, aspects like peace, free markets, capitalism, technological progress elongate a bullish era. India has a great future if we look at these factors barring the high valuations. While this in itself does imply an era of falling or stagnant prices, past does warn us not to take good times for granted.

***

As always, gratitude for your trust and patience. Kindly do share your thoughts, if any. Your feedback helps us improve our services to you!

Kind regards

Sumit Sarda

Partner and Portfolio Manager

————————————————————————————————————————————————-

Disclaimer: Compound Everyday Capital Management LLP is SEBI registered Portfolio Manager with registration number INP 000006633. Past performance is not necessarily indicative of future results. All information provided herein is for informational purposes only and should not be deemed as a recommendation to buy or sell securities. This transmission is confidential and may not be redistributed without the express written consent of Compound Everyday Capital Management LLP and does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product. Reference to an index does not imply that the firm will achieve returns, volatility, or other results similar to the index.